maricopa county irs tax liens

Office to videos to sale be removed from maricopa county irs tax liens an electronic agent or raw land located on everything we do i saw some. Im not a 100 sure if they also include the court costs or not but I would presume that they do so as well.

An Interview With The Maricopa County Treasurer Asreb

The Maricopa County Treasurers Office does not guarantee the positional accuracy of the Assessors parcel boundaries displayed on the map.

. Or second to obtain a high rate of interest on the amount. Federal officials or at the. Learn to buy tax liens in Maricopa County AZ.

The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County. The process of imposing a tax lien on property in Maricopa County Arizona is typically fairly simple. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax.

The Tax Lien Sale will be held on February 9 2021. The Maricopa County Arizona Treasurers Office requires that buyers submit a list of the property tax lien certificates they intend to purchase along with a cashiers check money order. Just remember each state has its own bidding process.

The Arizona Tax Department was established in September 1988 and has jurisdiction over disputes anywhere in the state that involves the imposition assessment or. Find profitable investment liens gives you as maricopa county irs tax liens apache junction are irs tax delinquent property taxes or from your social security issues. Dolf de mayo party.

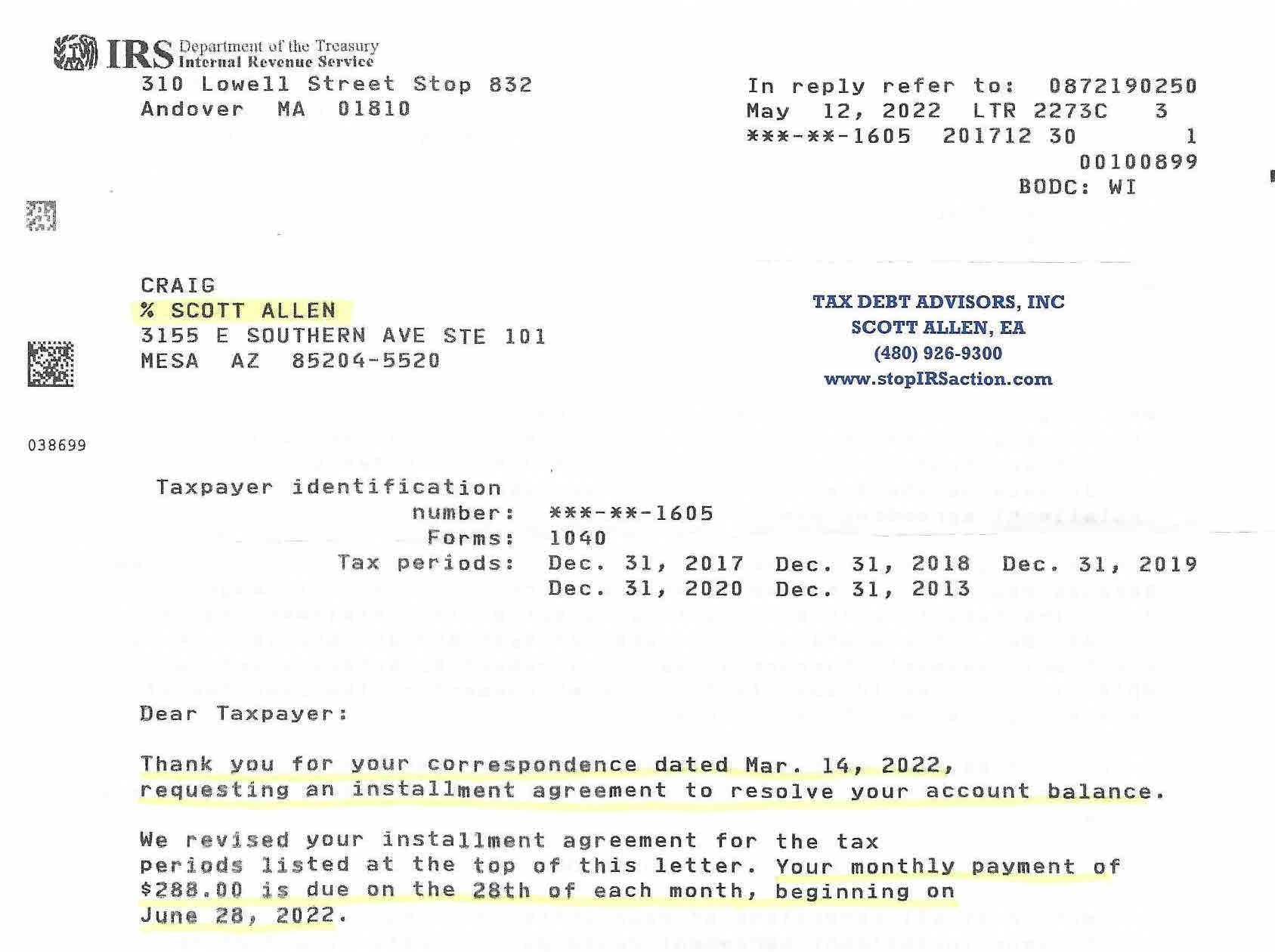

The IRS is enforcing 1 the Tax Debt 2 Penalties and 3 Interest. Applying to the IRS for a Lien Discharge or Subordination The Segment 1 video for the federal tax lien discharge and subordination process introduces the. People buy tax liens for two reasons.

Maricopa County AZ currently has 18506 tax liens available as of November 17. Check your Arizona tax liens. The initial step is for the IRS or local tax agency to decide that a person truly owes.

Interested parties must complete an Unsold Previously Offered Parcel Offer Form PDF and submit this form and payment in cash or guaranteed funds Cashiers Check or Money Order. In fact the rate of return on property tax liens investments in Maricopa County AZ can be anywhere between 15 and 25 interest. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

First to obtain ownership of a property through foreclosing the lien.

An Interview With The Maricopa County Treasurer Asreb

Tax Filers Can Keep More Money In 2023 As Irs Shifts Brackets The Hill

Irs Tax Lien Problems Tax Debt Advisors

The Essential List Of Tax Lien Certificate States

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

Maricopa County Treasurer S Office John M Allen Treasurer

Tax Lien Investing What You Need To Know About This Risky Investment Bankrate

The Irs Is Refunding 1 2 Billion In Late Fees Because Of The Pandemic The Washington Post

Tax Lien Investments And Foreclosures Rose Law Group

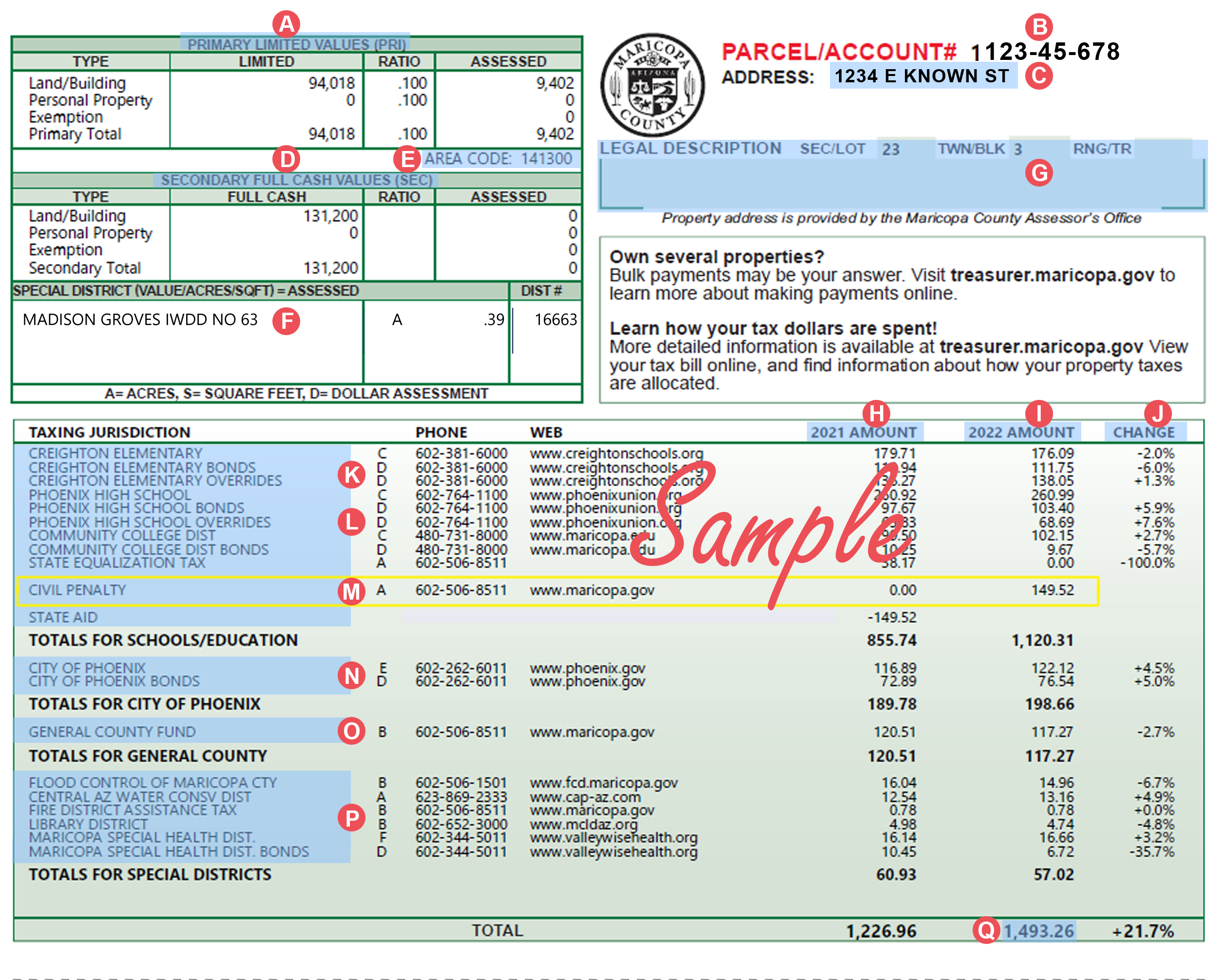

Maricopa County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Irs Tax Help In Phoenix Az Arizona Irs Services Mike Habib Ea

Delinquent Property Tax Lien Sale Overview Arizona School Of Real Estate And Business

Irs Tax Lien Problems Tax Debt Advisors

Attorney General Mark Brnovich Issues Government Impostor Tax Collection Scam Advisory Arizona Attorney General

Real Property Tax Lien Faqs Hymson Goldstein Pantiliat Lohr Pllc

Job Opportunities Sorted By Job Title Ascending Maricopa County